Investors face mounting public health risks and must lead change in food sector, new report finds

- The proportion of adults globally living with obesity is projected to increase to 3.3 billion by 2035; without intervention, global healthcare costs related to obesity could surpass $18 trillion by 2060

- If left unchecked, antimicrobial resistance-related fatalities could double by 2050, and by 2030, it could cause estimated losses to annual GDP up to $3.4 trillion

- Investors must actively integrate food and public health risks into their strategies to protect long-term value, while driving change that supports a healthier, more resilient global food system

23 June 2025: According to a new report commissioned by the First Sentier MUFG Sustainable Investment Institute, and conducted by Planet Tracker, rising obesity rates and antimicrobial resistance present a significant risk for investors. Increasing healthcare costs, productivity losses and regulatory pressures could pose serious risks and investors seeking to build sustainable long-term portfolios must assess company strategies for mitigating these risks and incorporate these considerations into their investment strategies.

The report emphasises that obesity is a leading contributor to non-communicable diseases, responsible for an estimated 42 million deaths annually, and ultra-processed foods are the primary drivers of this trend. Food marketing strategies exacerbate these health risks, targeting vulnerable communities through easily accessible and mainstream advertising content.

Childhood obesity in particular is an escalating global concern, with alarming statistics underscoring its rapid growth. According to UNICEF, around 30 million children under the age of five were overweight or living with obesity in 2000. By 2023, this number had risen to 37 million and the report examines how policies targeting the marketing of unhealthy foods to vulnerable groups, including children, may help prevent negative outcomes.

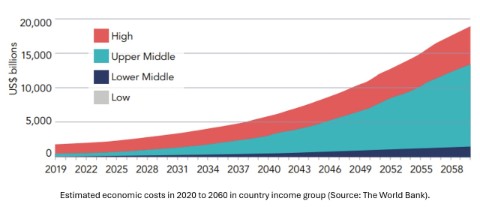

Of the 20% who consume the greatest amount of ultra-processed foods (in countries such as the USA, UK, and Australia), ultra-processed foods constitute between 70% and 80% of their diets. If current trends continue, the global economic burden of obesity is anticipated to surge from just under $2 trillion in 2020, to over $3 trillion by 2030, and $18 trillion by 2060 without intervention.

The global economic burden of obesity

Estimated economic costs in 2020 to 2060 in country income group (Source: The World Bank).

Rising risks posed by antimicrobial resistance

The report also highlights that the misuse of antibiotics in livestock and aquaculture is accelerating antimicrobial resistance, emerging as one of the top threats to global health, directly responsible for 1.27 million human deaths annually. If left unchecked, antimicrobial resistance-related fatalities could double by 2050, with significant economic consequences. The World Bank has estimated that by 2030, it could cause losses to annual GDP ranging from $ 1 trillion to 3.4 trillion.

Furthermore, findings show antimicrobial resistance in livestock in particular poses a systemic risk to the food and agriculture sectors as well as the pharmaceuticals, healthcare and insurance sectors. The result of this is major global financial repercussions and increased government regulation, as institutions seek to mitigate food sector-related risks.

Sudip Hazra, Director of the First Sentier MUFG Sustainable Investment Institute, commented: “Governments are introducing policies to address the growing health risks linked to poor diets and antibiotic misuse in agriculture, but real progress requires more than regulation. Investors have a powerful role to play in driving change. By actively engaging with food companies, they can accelerate the shift toward healthier, more sustainable practices and ensure compliance with evolving standards.

Investor pressure can reshape corporate strategies, reduce exposure to systemic risks, and support the long-term viability of the sector. Incorporating public health considerations into investment decisions is essential for safeguarding value and building a more resilient global food system.”

The report highlights key actions for investors, including encouraging companies to reduce their reliance on ultra-processed foods and curb the misuse of antibiotics in food production. Investors can also engage with food companies to set measurable targets for product reformulation, enhance the affordability of healthier options, and eliminate the routine use antibiotics in livestock and aquaculture.

About First Sentier MUFG Sustainable Investment Institute

The First Sentier MUFG Sustainable Investment Institute is jointly supported by First Sentier Investors and Mitsubishi UFJ Trust and Banking Corporation, a consolidated subsidiary of MUFG. The institute aims to help increase awareness and encourage action on important but under researched and emerging ESG-related issues. It will publish research on topics that can advance sustainable investing. An external academic advisory board informs the institute’s research agenda and ensures its publications meet high standards of rigour.

For more information, visit https://www.firstsentier-mufg-sustainability.com/

About the Planet Tracker

Planet Tracker is an award-winning non-profit think tank focused on sustainable finance.

We engage directly with the financial system and corporate management to drive transformation of global financial activities, achieve real world change in our means of production and align investment with a resilient, just, net-zero and nature-positive economy.

Our purpose is to ensure that capital markets’ investment and lending decisions are aligned with sustainable business practices and support a just transition.

About First Sentier Investors

First Sentier Investors is a global asset management group focused on providing high quality, differentiated and relevant investment capabilities to deliver exceptional investment performance for our clients. Today, across the First Sentier Investors Group, we manage [AU$208.1 billion/ US$129.7bn /£100.5 billion/ €120 billion]* in assets across global and regional equities, cash and fixed income, infrastructure and property, and alternative credit.

We are home to investment teams and brands such as AlbaCore Capital Group, FSSA Investment Managers, Igneo Infrastructure Partners, RQI Investors, and Stewart Investors. All investment teams operate with discrete investment autonomy, according to their investment philosophies and based on responsible investment principles.

Our organisation was acquired by Mitsubishi UFJ Trust and Banking Corporation, a wholly-owned subsidiary of Mitsubishi UFJ Financial Group, Inc in August 2019. We operate as a standalone global investment management business with offices across Europe, the Americas, and Asia Pacific.

We are a globally Certified B Corporation and signatory to the UK Stewardship Code.

*N.B. First Sentier Investors’ gross AUM, inclusive of associated strategic partnership with AlbaCore Capital Group, as of 31 March 2025.

For more information, visit www.firstsentierinvestors.com