Investors in global food supply chains face rising risks as extreme weather and climate change escalate, new research shows

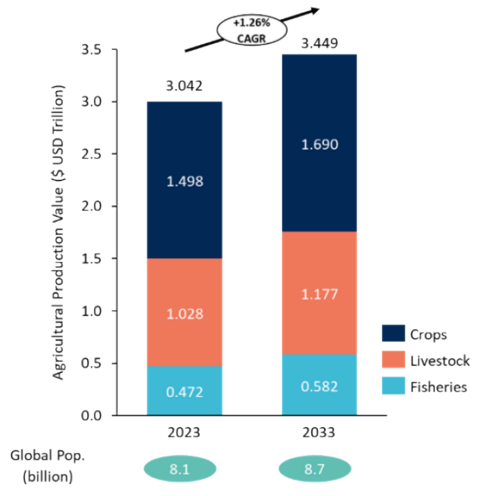

- Global food demand is set to grow at 1.26% a year over the next decade, driven by population, economic, and urbanisation growth.

- Yet global food systems face increasing extreme weather and climate change, impacting infrastructure, food value chains, to $38 trillion in damages by 2050.

- Investors can incorporate climate and extreme weather related risks into their investment strategies to mitigate impacts on the global food system and enhance food security, food system resilience, and commercial returns.

7th April 2025: According to a new report on global food supply chains, commissioned by the First Sentier MUFG Sustainable Investment Institute, and conducted by Baringa, both direct and indirect investors in globally integrated supply chains face significantly increasing climate risks and extreme weather hazards. These hazards, impacting global food supply chains demonstrate the need for businesses and investors to take action to support food security, food system resilience, and commercial returns.

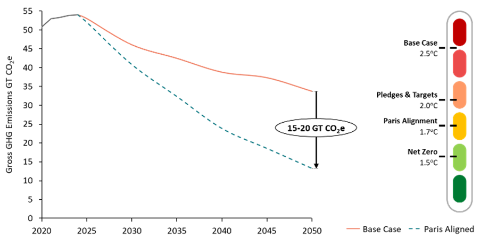

The report emphasises that the world is on track to 2.5 degrees centigrade of global warming by 20501, and highlights that Intergovernmental Panel on Climate Change (IPCC) has verified positive correlations between increased emissions and increased occurrence of extreme weather hazards, posing increased risks for global food supply chains.

In tandem with this, its analysis highlights global food demand is set to grow at 1.26% CAGR over the next decade, driven by population, economic, and urbanisation growth. At the same time as pressure on them is rising, global food systems are becoming increasingly complex due to economic demand and changing diets. This in turn is driving up costs of production (agricultural production value) in almost every region at a much faster pace than the rising population (0.7% per year). The result of this is that global food systems supplying this increased demand will face a higher likelihood of insecurity and commercial losses.

Sudip Hazra, Director of the First Sentier MUFG Sustainable Investment Institute commented “The world is racing towards crossing climate tipping points that threaten significant impacts on agricultural systems. Investor decision-making and engagement strategies concerning agricultural and food system companies, therefore, should consider incorporating these risks, and adapting initiatives that can enhance food security, food system resilience, and commercial returns.

“There are opportunities for investors to facilitate a course correction in global food supply chains by incorporating physical climate risk into their investment decision-making. Investors can play a critical role in de-risking agricultural businesses from the escalating climate impacts by supporting their companies to consider and disclose the areas relating to best practice across a holistic reporting framework. This can include value chain maps outlining core partners and regions, relevant physical climate impacts, related risks and opportunities, and efforts to ensure business resilience.”

The report highlights that global food systems face six key extreme weather events that have the potential to impact infrastructure, food value chains, and wider natural ecosystems, projecting an estimated cost of up to $38 trillion in damages by 20502. These six key hazards include: temperature extremes, heavy precipitation, flooding, droughts, extreme storms, and compound events. These key hazards have the potential to reduce agricultural yields up to 20% in a 2.5oC global warming by 2050 scenario, the report’s base case.3

Footnotes

1 “Baringa Base Case”, Baringa (2024); this considers full Greenhouse Gas Emissions from energy, industry, agriculture, and land use change & forestry, and is informed by the outcome of the latest climate policies, pledges, and their deliverability.

2 “Emissions Gap Report”, UNEP (2024) and “The economic commitment of climate change”, Koz et al., Nature (2024).

3 “Climate Change 2023 Synthesis Report”, IPCC (2023).

Media enquiries:

About First Sentier MUFG Sustainable Investment Institute

The First Sentier MUFG Sustainable Investment Institute is jointly supported by First Sentier Investors and Mitsubishi UFJ Trust and Banking Corporation, a consolidated subsidiary of MUFG. The institute aims to help increase awareness and encourage action on important but under researched and emerging ESG-related issues. It will publish research on topics that can advance sustainable investing. An external academic advisory board informs the institute’s research agenda and ensures its publications meet high standards of rigour.

For more information, visit https://www.firstsentier-mufg-sustainability.com/

About the Trust Bank

Mitsubishi UFJ Trust and Banking Corporation, as a core member of MUFG, provides its customers with a wide range of comprehensive financial solutions leveraging unique and highly professional functions as a leading trust bank. Such financial solutions include real estate, stock transfer agency, asset management and investor services, and inheritance related ser-vices, in addition to banking operations. We aim to realize our vision to be the trust bank that can create a safe and enriching society and a future alongside the customers through trust (faith and entrustment), and thus created a new key concept: “Create a Better Tomorrow”.

For more information, visit: https://www.tr.mufg.jp/english

About Baringa

Baringa is a global management consultancy focused on creating intelligent and lasting impact for government, industry, finance, and society. Our 2,000 experts operate globally with offices across Europe, North America, Asia, and Australia. We focus on designing and delivering meaningful change, and work across numerous sectors including Agriculture, Consumer Retail, Energy & Resources, Finance, Government, Industry, Pharma, Private Equity, and TMT.

For more information, visit: https://www.baringa.com